nh property tax calculator

The current real estate tax rate for the City of Franklin NH is 2321 per 1000 of your propertys assessed value. Tax Rate is 1862 per 1000 of value.

The 2020 Hopkinton Property Tax Town Of Hopkinton Nh Facebook

Assessing department tax calculator.

. Your average tax rate is 1198 and your marginal tax rate is 22. In this largely budgetary operation county and local governmental leaders determine annual expenditures. Real Estate Tax Rate.

2013 City of Concord NH. When totalled the property tax load all owners bear is established. Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average.

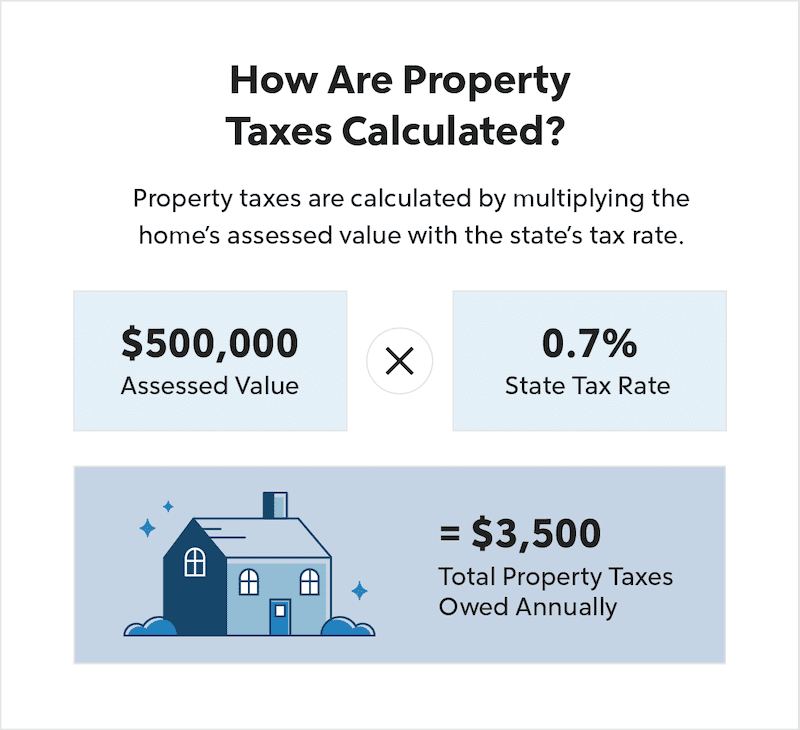

Look up your property tax rate from the table. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The assessed value multiplied by the real estate.

This marginal tax rate. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

Our New Hampshire Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax. A complete listing of assessed values is sorted by owner for the 2021 Tax Year. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The current 2019 real estate tax rate for the Town of Brookfield NH is 1670 per 1000 of your propertys assessed value. There are three main stages in taxing real estate ie formulating levy rates estimating property market worth and taking in tax revenues.

The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. Calculate your real tax bill incorporating any exemptions that apply to your property. A complete description of property site specific.

Realistic real estate worth appreciation will not raise your yearly bill sufficiently to make a protest. The assessed value multiplied by. The assessed value multiplied by the tax rate.

Every unit then receives the tax it levied. New Hampshire Real Estate Transfer Tax Calculator. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply. Ad Get In-Depth Property Tax Data In Minutes. The assessed value multiplied by the tax rate equals the.

New Hampshires tax year runs from April 1 through March 31. Look up your property tax rate from the table. Start Your Homeowner Search Today.

If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

Real Estate Taxes Vs Property Taxes Quicken Loans

Dover Tax Bills Go Up 245 90 For Average Single Family Homeowners

Property Taxes Lagged In 2021 Even As Real Estate Prices Soared

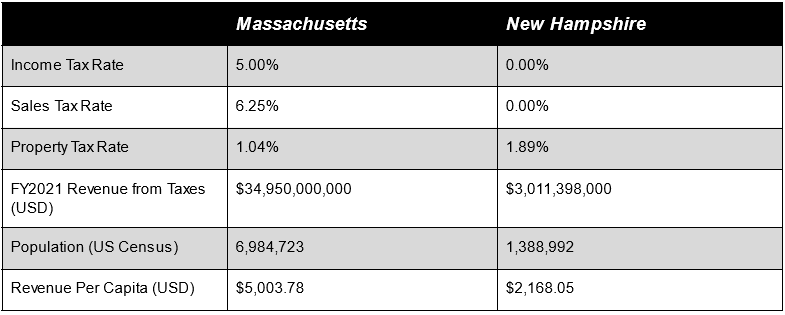

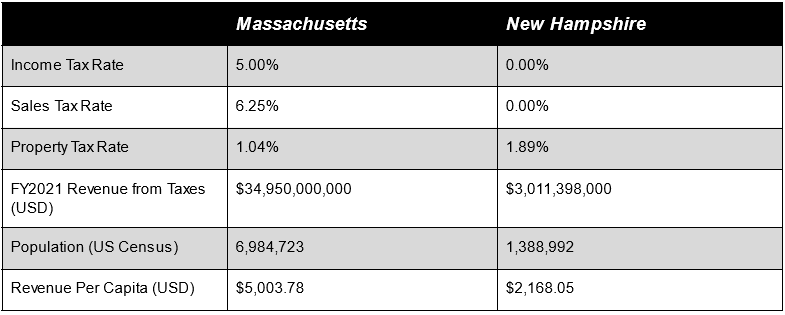

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

New Hampshire Tax Rates Rankings Nh State Taxes Tax Foundation

Newmarket Tax Rate Set At 25 46

Is New Hampshire Really As Anti Tax As It S Cracked Up To Be Stateimpact New Hampshire

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

New Hampshire Paycheck Calculator Smartasset

Derry Establishes Tax Rate At 26 12 Town Of Derry Nh

Exeter 2021 Property Tax Rate Set At 24 01 1 000 Town Of Exeter New Hampshire Official Website

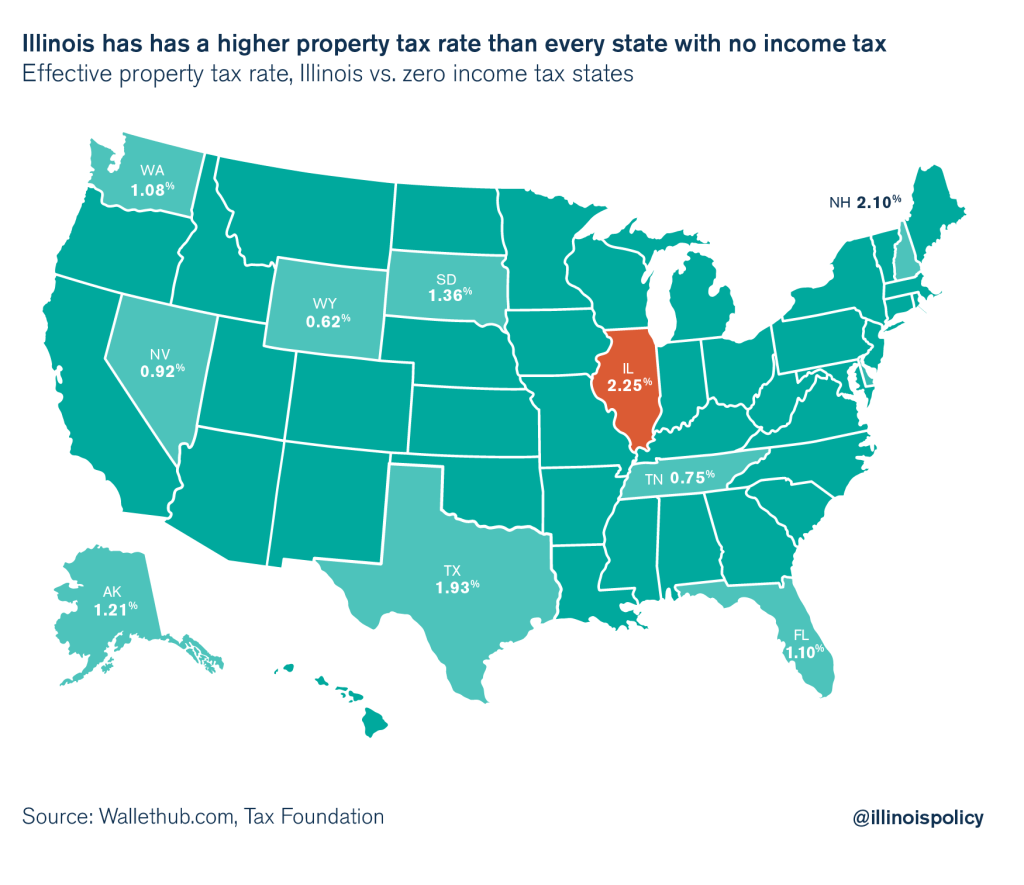

Illinois Has Higher Property Taxes Than Every State With No Income Tax

Property Tax Bills Town Of New London Nh

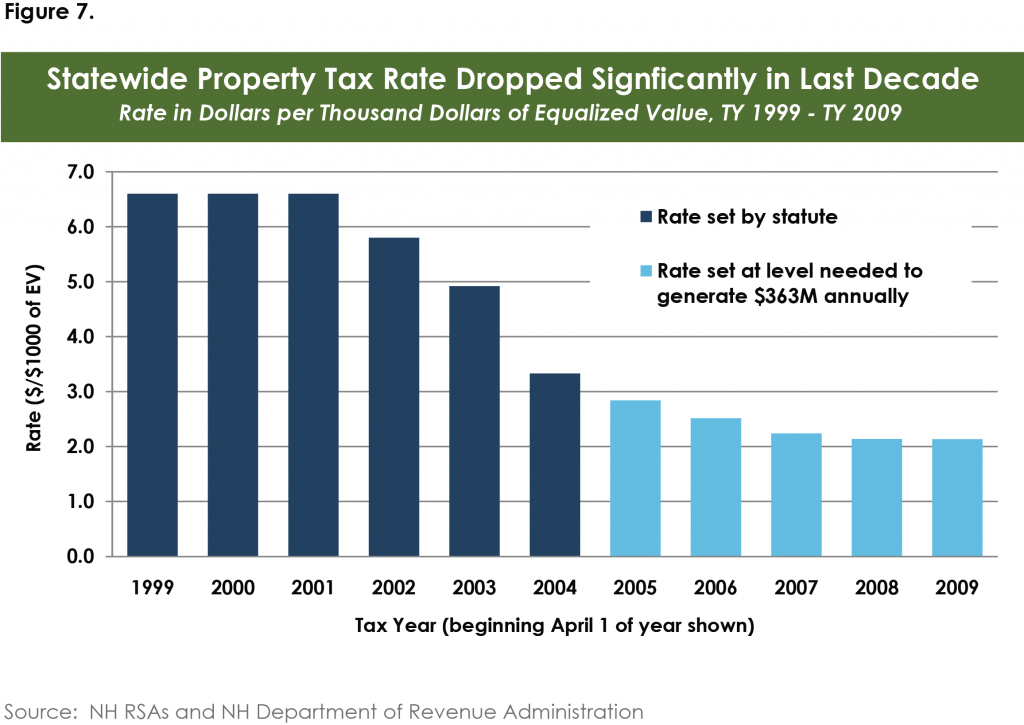

An Overview Of New Hampshire S Tax System New Hampshire Fiscal Policy Institute

Mark Fernald Why Your Property Taxes Are So High

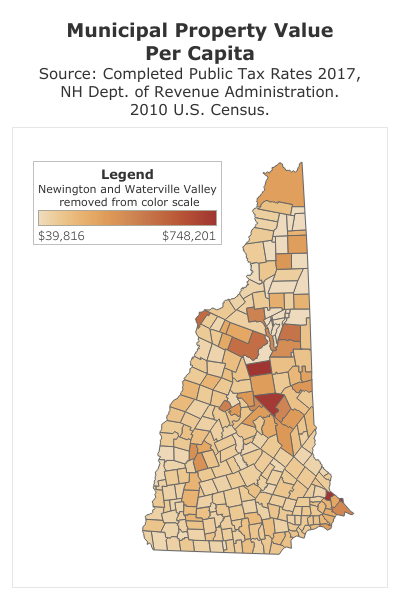

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute